CIBIL IS JUST A CREDIT BUREAU FOR SOME INFORMATION: NOT HERE TO RUN INDIAN REPUBLIC OR LIVES OF ITS PEOPLE

CIBIL IS JUST A CREDIT BUREAU

FOR SOME INFORMATION:

NOT HERE TO RUN INDIAN REPUBLIC

OR LIVES OF ITS PEOPLE

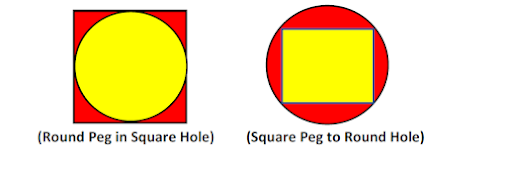

A credit bureau is a private information source only for guidance purpose for advancing credit by Banks and Financial institutions. It is not the Bible (or epic of any other faith for that matter-as proverb) or whole and sole rule book to be followed for extending lending. On the other hand, CIBIL should not think as if it will intrude into Indian lending/credit market as a maker or breaker, because it is not here to run the Republic of India or lives of its people. It’s business is to maintain some information as a licensed company when given to it and it cannot have any role in who will use it or not or how to use it compulsorily. There was some campaign by CIBIL on moratorium during Covid-19 at the instance of a private bank, which has now been stopped by public complaints and it was unfortunate as well as uncalled for. CIBIL in India was a private company in the past promoted by a private bank as one of its group companies and later, not many years back, it was purchased by Transunion of USA and today it remains as a private credit bureau that is all. It is not necessarily that the information provided by CIBIL is fool proof or correct. It may not be updated or may be outdated in a lot of cases. In multichannel lending and in multichannel recovering where there are disjointed activities in multichannel in a large economy with a large part of it in unorganized business, lot of un-updated and obsolete information would be lying as a pile of trash and if it is relied upon for running an economy only sufferings and misery of its people can be expected. RBI as the regulator in India should not force the Banks and Financial Institutions to follow CIBIL as the Bible and rule of standard to extend lending for retail credit market. The lending should take place in retail market based on ground realities and not on the CIBIL scores as if it is the pass or fail marks of an educational examination to be eligible for some placement or admission in higher education.

In fact, RBI as the regulator, must

instruct Banks and Financial institutions that, CIBIL score is an optional

guide and not the rule of standard for retail credit advancing. Otherwise,

whole retail credit market is facing blockade by undue reliance and abusive use

of CIBIL score, a private methodology of making such a score may not be based

on accurate information and using such score putting a pin to block somebody’s

otherwise possible lifeline.

It was appalling to hear by firsthand

experience from some men/women entrepreneurs after having suffered during Covid-19

pandemic and lock down in vogue, when they wanted to take some borrowing under

Mudra Scheme to come to life again, the Banks want to go to CIBIL score to

decide, very funny. The Government has announced Mudra Scheme to assist people

by giving its own Government Guarantee and allowing people very small credits

without guarantee and collaterals so that they can earn some life line in their

way and pay back to the banks. It is a kind of trust on Indian Citizens as

retail credit market who are really not bad in repaying the small credits which

has been seen from small credits given for Motor Cycles, Scooters, Scootys and

Small Agricultural Equipment, even for tractors, Lathe Machines, Garages,

Restaurants and Small Retail (Kirana) Stores and so on as example. Basing on

such small retail credits like Motor Cycles and Scootys, some private Banks who

had started with modest beginning have grown to become some of the largest

lenders of India. Did CIBIL score any magic for them? When and where was it

pushing their growth? Who took their lending and paid back to them with fatty

interest rates so that they not only grew by their balance sheet they also grew

by their large market capitalization in stock exchanges, It is these Indian

Citizens of retail markets who have added to their accumulated fat of

growth. Then what is the fear of lenders to go to CIBIL checking,

while such people may not have or have some no-accurate CIBIL data. There is no

guarantee that the CIBIL information is correct for small retail credits

primarily due to multi-leg and multi-channel processing of information and

historically not updated.

About the Author : Dr. Nimain Charan Biswal is a B.Sc.(Agri. Science and Technology). M.B.A. and Ph.D.( Management Area ) by qualifications and he has 34+years of work experience in both industrial and development sectors in diversified fields of social importance. He has been educated at Orissa University of Agriculture and Technology (OUAT)-Bhubaneswar, Institute of Rural Management Anand (IRMA) and Gujarat University ( with Resource Support of IIM-Ahmedabad ). Dr.Biswal is further educated at IIM-Calcutta, XLRI-Jamshedpur, Apple Computer Industries and Spar Inc., USA. He has worked for reputed National and International Organisations in Senior/Top Management Capacities. He is a management expert, a prominent professional of India and known Internationally as well. He lives at Mumbai in India.

.jpg)

Ideas are brought in without thinking our Indian peoples mind.

ReplyDelete